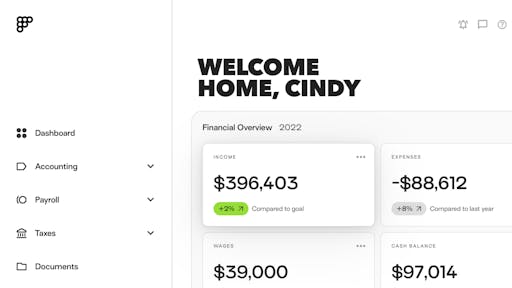

ACCOUNTING SOFTWARE FOR THE SELF-EMPLOYED

Mind Your Business. Not Your Books.

Thousands of self-employed customers stress less, spend less time, and save an average of $14K each year by putting their back office on autopilot with Formations.

GET STARTED (we'll show you which plan fits your needs)

You didn't start a business to do this s#!t.

Taxes are complicated, and you don't have time for this—but we do. With Formations, you get a tax-efficient business structure, full control and visibility of your business financials, and automatic tax management for your business to achieve predictable tax savings year-over-year.

$120K

Net Income

$7,344

Self-Employment Tax

The right structure for your business

Maximizing tax savings begins with building an efficient structure that makes the most of the tax code. Formations evaluates your business and creates the most tax-efficient structure for you.

Calculate Your SavingsDon't just pay your taxes, manage them.

Taxes are the largest expense for your business and they should be managed year-round, not just at tax season. Formations automatically manages your tax estimates, payments, and deductions, so you don't need to worry about it.

Learn More

No More Tax Stress

Know your tax situation at any time, including how much you've paid and how much you owe. Simulate savings from new tax strategies, act, and file with the click of a button.

Learn More

Not another do-it-yourself solution

You have questions; we have answers. We also have answers to questions you haven't asked yet! Formations gives you real-time visibility and control over your finances and access to expert advice so you can make the best decisions about your business.

Learn MoreSelf-Employment Made Simple

Transform the Way You Run Your Business

The Blog

Dive into exclusive content for the self-employed including curated news, interviews, and more.

FAQ

New to Formations? Here are some of the questions we get asked most often.

Webinar

Join us for our next webinar, which will explain how incorporating your business can help protect you and your assets.